I have to get to work so I'll make this quick - I just want to share what I am going through. Here's the email that I sent to them; apparently you can "dispute" your balance. No one's ever told me that before.

I'd love to hear your stories if you have similar experiences to share. The collector is a government contractor, collecting for the Department of Education, Windham Professionals.

My original principal was under $30,000. My current balance is $138,000 – Four and a half times what I initially borrowed. In addition, I did make payments on this debt; in my estimation totaling about $12,000.

I will agree to reasonable terms, not usurious ones. The only reason I “agreed” to the various loan deferments, forbearances and consolidations was because I had no other choice. There were times I would have filed bankruptcy, but student loans are the only financial instrument in this country that are not able to be renegotiated or discharged in bankruptcy. I. Had. No. Choice.

I had virtually zero income from 2008 – 2011. I was on federal assistance and food stamps. In that time, I was in your so-called “sliding scale” payment “arrangement”, and in that time my balance DOUBLED. Before that, I was paying when I could. Even as I watched my balance increase exponentially, I continued to pay. But now, to see this ridiculously huge balance, even after almost 20 years of acting in good faith, I say stop.

I am not trying to run away from my debt. I will agree to pay back what I borrowed, minus what I have already paid, and agree to REASONABLE terms. Reasonable terms do not include paying 460% of my original principal. I refuse to enter into any kind of payment arrangement until these terms are agreed upon.

I basically have no motivation to pay this back under these conditions. I know that, in default or not, whether I pay or not, the ridiculous interest on this loan has ruined my financial future. I own nothing of value. I have no assets. I am self-employed and make a meager income. I have nothing for you to take away from me. If you want to recuperate anything at all, then allow me to renegotiate this down to something that is reasonable, that will allow me to see a financially stable future for myself - not one that will keep me mired in impossible debt for the rest of my life.

1:53 PM PT: Thank you all so much for the support, the great ideas, and sharing your stories. Once again, I have to work. I have a busy day today and this was a very unexpected detour.... but I sure feel better sharing with my fellow Kossacks...

Thanks for the rec list and I'll be checking in later!!!

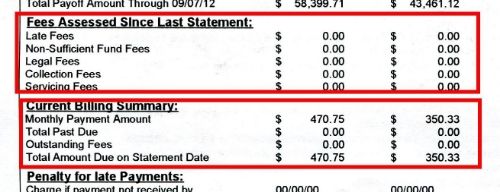

So if you're curious as to what a bill from the Department of Education looks like for a $0.00 payment due on a $100,000 loan balance, here it is. This is from August of 2012 - note that I was not in default.

Here's a close-up: